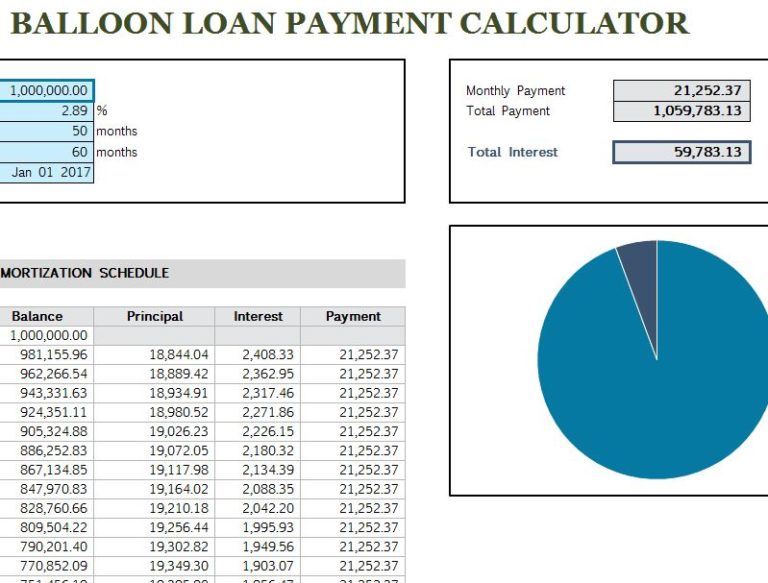

The loan calculator featured on this page uses the following formula to calculate repayment figures: The APR or Effective Annual Rate represents the yearly The pie chart shown with your personal loan calculator results displays the total interest as a percentage of the total amount paid back.

Why is the loan repayment interest % different to the APR? Takes that information into account, giving you a simple percentage interest rate to allow you to compare and shop around. When you arrange a loan with a finance company, their offer can include extra fees associated with the loan. What is APR?ĪPR stands for Annual Percentage Rate and is an important factor in determining the overall cost of a personal loan. You can find out more about balloon payments here. It is commonly used in car finance loans as a way of reducing What is a balloon payment?Ī balloon payment is a large, lump-sum payment made at the end of a long-term loan. We have an article discussing the differences between This loan calculatorĬompounds interest on a monthly basis. The effective annual rate is the yearly interest rate that you're paying on a loan, taking into account for the effect of compounding. Here are some common questions that you have been asking about our calculator: What is the effective annual rate? Should you wish to calculate loan figures without compounding, give You will also be shown graphs and a monthly repayment schedule of your principal and personal loan interest payments. Once you click the 'calculate' button, the personal loan calculator will show you: If you wish, you can alter the start loan date and include any additional deposits you are making at the beginning, along with any extra fees orīalloon payments. To begin your calculation, enter the amount you are hoping to borrow along with the yearly interest rate and the number of months that you are intending toīorrow the money for. Possible loan repayments, you can then feel better informed when you weigh up the risk and reward of taking out the loan. Our loan calculator can assist you by creating projections for monthly repayments based upon the amount you are looking to borrow. Paying for funeral expenses (sadly becoming more common!)Īdvertisement Why use this loan calculator?.Options available to you will depend upon your credit history.Ĭommon reasons for taking out a personal loan in 2022 include: 1 Of course, there are many different types of loans - both unsecured and secured - and they all carry different degrees of risk vs reward and varying rates of interest. Of a lump sum of money upfront, and then gradually pay the money back to the lender. Personal loans offer you an opportunity to get hold These days, it seems like we're bombarded by advertisements offering us personal loans, and instant credit seems like it's never been so easy and attainable.

0 kommentar(er)

0 kommentar(er)